World News

Opinion | How to Raise a Trillion Dollars

-

General News5 days ago

General News5 days agoKenya Police Recruitment Training: Complete Preparation Guide

-

General News1 week ago

General News1 week agoMagoya Boils! CS’s Choice Moses Omondi Cornered by Angry Ugunja Youths

-

General News1 week ago

General News1 week agoHow the Government Sank Sh49.5 Billion Into Housing Projects Without Land Ownership

-

General News1 week ago

General News1 week agoFrom Ivory to Rhino Horn: How Feisal Mohamed Ali Keeps Escaping Justice

-

General News1 week ago

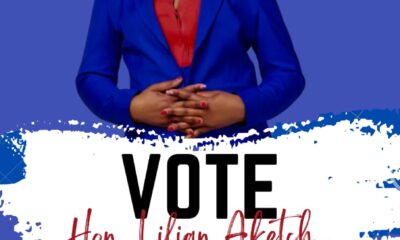

General News1 week agoA New Hope in Ugunja: Lillyanne Aketch’s campaign is shaking up the by-election.

-

General News5 days ago

General News5 days agoRyan Injendi Hits Out at Mudavadi Over Malava UDA Nominations

-

General News1 week ago

General News1 week agoGithunguri MP Gathoni Wamuchomba Denies Claims of Spying for UDA

-

General News5 days ago

General News5 days agoWhat to Do If You Are Unfairly Disqualified from Police Recruitment in Kenya