Part 1 : The Symptoms

The story of Centum is a tragic story! It is a story of how a bonus system crafted to feed corporate greed has driven a once solid company from pursuing long term sustainable initiatives, for the good of its shareholders, into a selling frenzy of good assets and debt binging all in pursuit of immediate profits and bonuses. All at the watch of a competent board elected by shareholders who entrusted them with their investments. It is a story of how one man has in 14 years made a fortune and left 37,000 investors at risk of losing an investment that most have held for over 5 decades! It’s a story of how corporate greed, beautifully run public relations activities and a blind eye by those meant to protect the shareholders has misled even the savviest of business journalists to sing praises of a man who in his 14 years at the helm has only succeeded in building a personal empire so vast, most could only dream of.

It all began in May of 2008 when a little then known James Mworia, at only 31 years of age rose to the helm of CEO at Centum Investment. He was touted as one of the youngest CEOs in his time. James Mworia is brilliant as he is charming and has enjoyed well deserved accolades winning several business awards including being named Top 40 under 40 multiple times. His tenure as CEO of Centum at face value has been quite impressive but a peek behind the numbers and the glossy and well-choregraphed public relations campaigns tells a different story.

Whoever said you cannot be rich through employment had probably not met one James Mworia! Over his 14 years as CEO of Centum, Mworia (according to the company’s annual reports) has earned a staggering Kes 1.1 billion in compensation translating to Kes 78.5 million per year most of which has been paid in bonuses. What’s more impressive is that his executive compensation accounts for more than 30% of the entire staff costs of Kes 3.5 billion which include salaries, medical, pension, bonuses etc over that period. This may not be as shocking to some until you consider that in that same period, 37,000 shareholders of Centum have only earned Kes 3.8 billion in dividends. In that same time frame the share price of Centum has stagnated delivering to Investors a measly 1% per year with the market capitalization growing from Kes 7 billion to Kes 7.7 billion only. These Investors, majority of whom are quite old, would have been better off investing their hard-earned money in a government bond with very low risk and earned a return of 12% per year with attractive cash flows.

There have been murmurs in the market surrounding Centum’s growing and unsustainable debt levels which in some part has been reflected by the declining share price as the market seeks to price in the risks associated with the high debt. But what is more interesting has been the lack of analyst reports or even media articles to cover this growing concern and a lot of information has been quite expertly managed by the company and its auditors. For example, as the interest payments have continued to grow to an astounding Kes 4 billion a year, Centum has resulted to very creative reporting by splitting the consolidated income statements into segments which breaks down the finance costs into smaller (more palatable) sizes according to business type to distract the less sophisticated minds from the bigger picture – looking at the 2021 annual report vs previous year’s annual report. Note that this kind of segmenting is generally done under the financial statement notes.

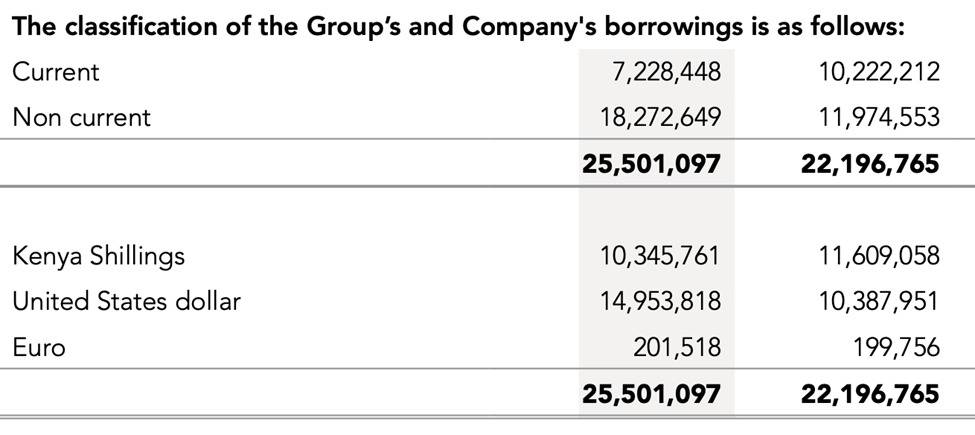

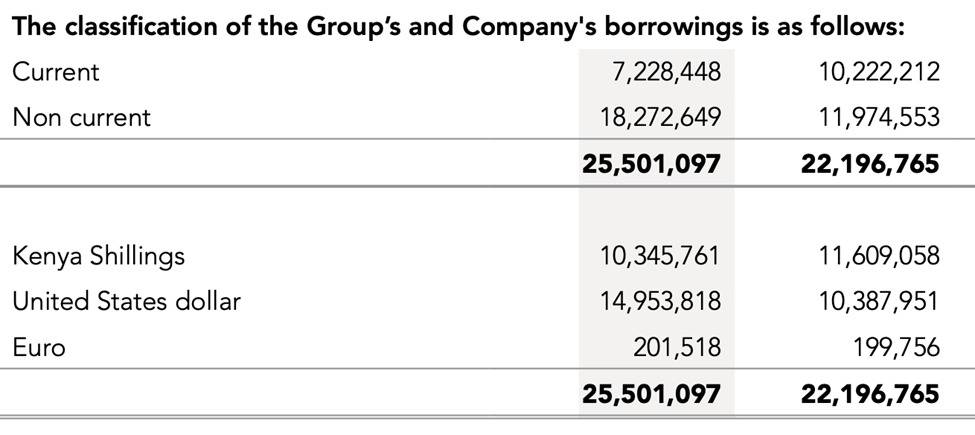

Digging down into the financials, a grim picture rises showing that most of this debt especially under the real estate subsidiaries are either guaranteed by Centum or are clustered in entities where Centum is the majority shareholder – meaning that if these businesses chocked under the debt, then Centum would lose a substantial part of its assets. The reporting tries to show a rosier picture detailing only the company’s net debt position vs its market value of investments while ignoring the systemic risk that underlies the relationships across the entities.

Even more concerning is the level of revaluation gains built into the carrying value of some of Centum’s real estate assets. A good example would be on page 166 of the 2021 integrated financial report which details the fair value of its subsidiaries relative to cost. 3 subsidiaries stand out being the Two Rivers Development with a carrying value of Kes 5.2 billion vs a cost of Kes 1.2 billion, Centum Development with a carrying value of Kes 3.2 billion vs a cost of just Kes 91,000 and Vipingo Development and Vipingo Estates Plc which are carried at a staggering Kes 12.9 billion compared to the cost of just 386 million. That means that across these entities, Centum has a carrying value of Kes 21.3b compared to an investment of Kes 1.6b, a 13x unrealised upside!!

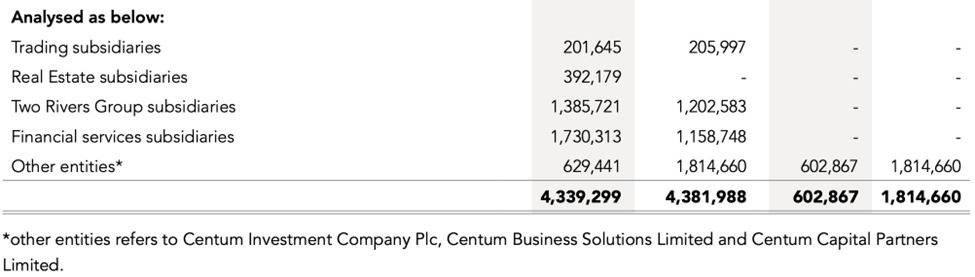

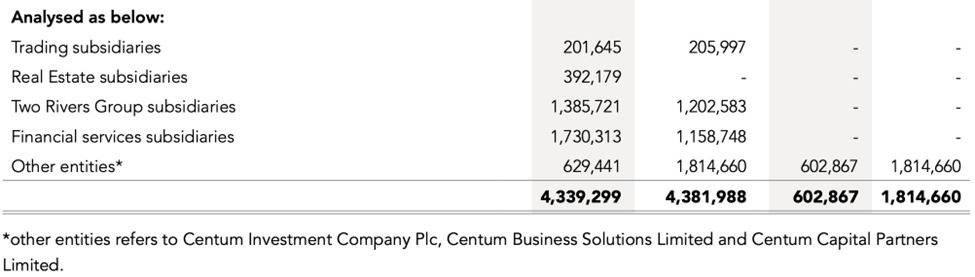

Keeping in mind that debt repayments are obligations that require cash flow to service the payments, on the other hand the real estate assets are illiquid assets that require long periods of time to generate the cash flows. One only needs to look at the collection record of Centum from its real estate portfolio vs its interest payments alone to begin to comprehend the extent of the looming trouble. A quick example would be to look at the financial position of the Two Rivers Mall as show on page 178 of the report which shows the current assets of Kes 2.5 billion compared to current liabilities of Kes 11 billion to realize that some of these entities are technically insolvent. The snapshot below shows the breakdown of the debt with two key concerns being the amount of current debt in 2021 standing at Kes 7.2b and even more concerning being the USD denominated debt worth almost Kes 15b at a time when the Kenya shilling has lost 15% of its value over just 2 years!

It is interesting to note that Centum has been audited by the same audit firm, PriceWaterhouse Coopers, for the last ten years. An interesting scenario considering global corporate governance standards and requirements to rotate auditors. Which raises the questions of governance, where is the board? Is it an active board or a CEO rubber stamp?

The Centum board constitutes astute and experienced professionals with hundreds of years of combined experience in investments, management, governance, and leadership. It has been chaired by Dr. Donald Kaberuka for the last five years since 2016. He leads a prominent list of directors on the board. It is thus surprising that there has been no clear communicated planned correction to a dangerous course the business is taking. Centum seems to be having the typical agency problem (where typically the management and the board benefit from the company to the detriment of principal owners of the business, the shareholders).

NOTE: This is part 1 of 3 series and will continue in next segment.

Business News1 week ago

Business News1 week ago

Business News2 days ago

Business News2 days ago

Entertainment9 hours ago

Entertainment9 hours ago